FIGURE 7.1: Scheme of a perceptron.

FIGURE 7.1: Scheme of a perceptron.

Neural networks (NNs) are an immensely rich and complicated topic. In this chapter, we introduce the simple ideas and concepts behind the most simple architectures of NNs. For more exhaustive treatments on NN idiosyncracies, we refer to the monographs by Haykin (2009), Du and Swamy (2013) and Goodfellow et al. (2016). The latter is available freely online: www.deeplearningbook.org. For a practical introduction, we recommend the great book of Chollet (2017).

For starters, we briefly comment on the qualification “neural network”. Most experts agree that the term is not very well chosen, as NNs have little to do with how the human brain works (of which we know not that much). This explains why they are often referred to as “artificial neural networks” - we do not use the adjective for notational simplicity. Because we consider it more appropriate, we recall the definition of NNs given by François Chollet: “chains of differentiable, parameterised geometric functions, trained with gradient descent (with gradients obtained via the chain rule)”.

Early references of neural networks in finance are Bansal and Viswanathan (1993) and Eakins, Stansell, and Buck (1998). Both have very different goals. In the first one, the authors aim to estimate a nonlinear form for the pricing kernel. In the second one, the purpose is to identify and quantify relationships between institutional investments in stocks and the attributes of the firms (an early contribution towards factor investing). An early review (Burrell and Folarin (1997)) lists financial applications of NNs during the 1990s. More recently, Sezer, Gudelek, and Ozbayoglu (2019), Jiang (2020) and Lim and Zohren (2020) survey the attempts to forecast financial time series with deep-learning models, mainly by computer science scholars.

The pure predictive ability of NNs in financial markets is a popular subject and we further cite for example Kimoto et al. (1990), Enke and Thawornwong (2005), Zhang and Wu (2009), Guresen, Kayakutlu, and Daim (2011), Krauss, Do, and Huck (2017), Fischer and Krauss (2018), Aldridge and Avellaneda (2019), Babiak and Barunik (2020), Y. Ma, Han, and Wang (2020), and Soleymani and Paquet (2020).17 The last reference even combines several types of NNs embedded inside an overarching reinforcement learning structure. This list is very far from exhaustive. In the field of financial economics, recent research on neural networks includes:

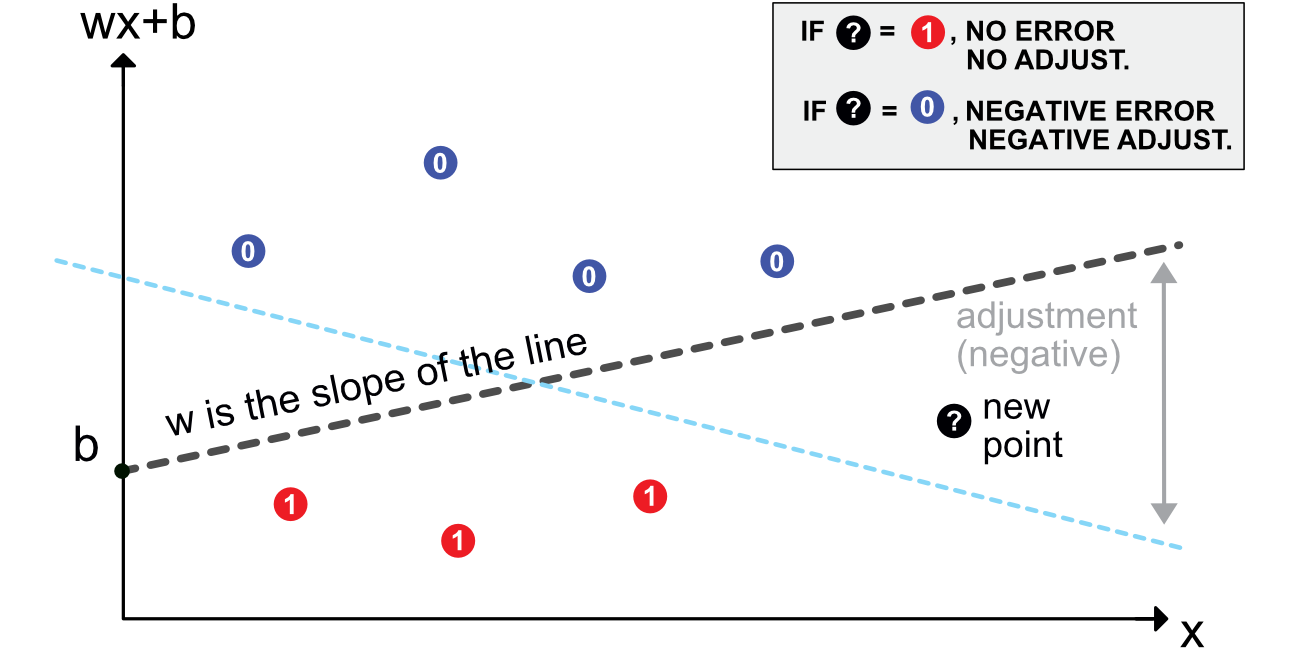

The origins of NNs go back at least to Rosenblatt (1958). Its aim is binary classification. For simplicity, let us assume that the output is $\{0$ = do not invest $\}$ versus $\{1$= invest $\}$ (e.g., derived from return, negative versus positive). Given the current nomenclature, a perceptron can be defined as an activated linear mapping. The model is the following:

The vector of weights $\mathbf{w}$ scales the variables and the bias $b$ shifts the decision barrier. Given values for $b$ and $w_i$, the error is $\epsilon_i=y_i-1_{\left\{\sum_{j=1}^Jx_{i,j}w_j+w_0>0\right\}}$ As is customary, we set b=w0 and add an initial constant column to $x$: $x{i,0}=1$, so that $\epsilon_i=yi-1{\left{\sum{j=0}^Jx{i,j}w_j>0\right}}$. In contrast to regressions, perceptrons do not have closed-form solutions. The optimal weights can only be approximated. Just like for regression, one way to derive good weights is to minimize the sum of squared errors. To this purpose, the simplest way to proceed is to

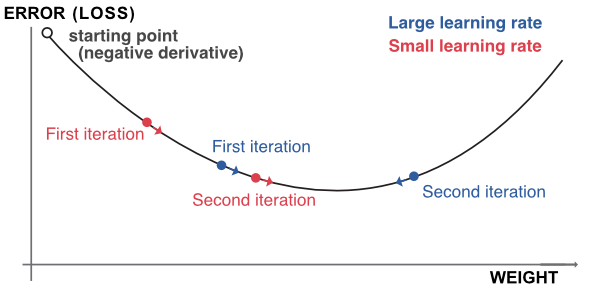

which amounts to shifting the weights in the direction. Just like for tree methods, the scaling factor $\eta$ is the learning rate. A large $\eta$ will imply large shifts: learning will be rapid but convergence may be slow or may even not occur. A small $\eta$ is usually preferable, as it helps reduce the risk of overfitting.

In Figure 7.1, we illustrate this mechanism. The initial model (dashed grey line) was trained on 7 points (3 red and 4 blue). A new black point comes in.

FIGURE 7.1: Scheme of a perceptron.

FIGURE 7.1: Scheme of a perceptron.

At the time of its inception, the perceptron was an immense breakthrough which received an intense media coverage (see Olazaran (1996) and Anderson and Rosenfeld (2000)). Its rather simple structure was progressively generalized to networks (combinations) of perceptrons. Each one of them is a simple unit, and units are gathered into layers. The next section describes the organization of simple multilayer perceptrons (MLPs).

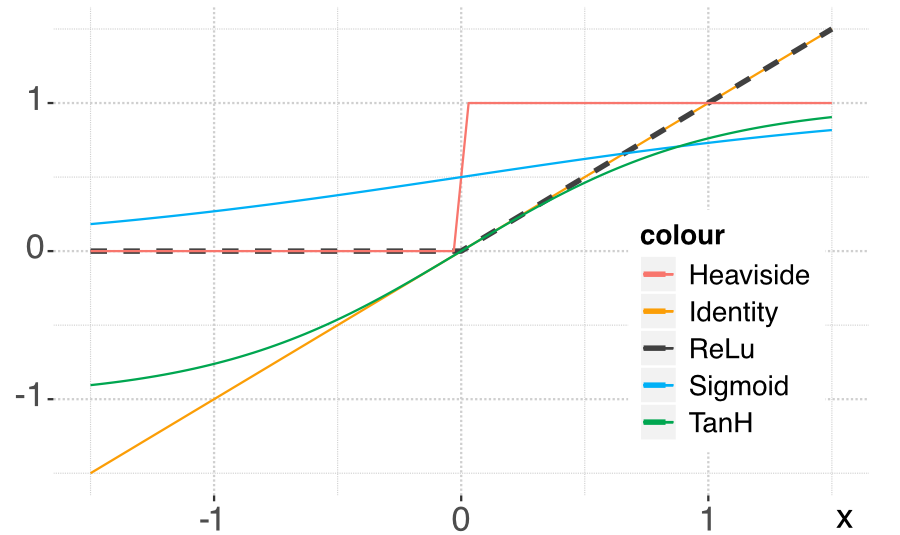

A perceptron can be viewed as a linear model to which is applied a particular function: the Heaviside (step) function. Other choices of functions are naturally possible. In the NN jargon, they are called activation functions. Their purpose is to introduce nonlinearity in otherwise very linear models.

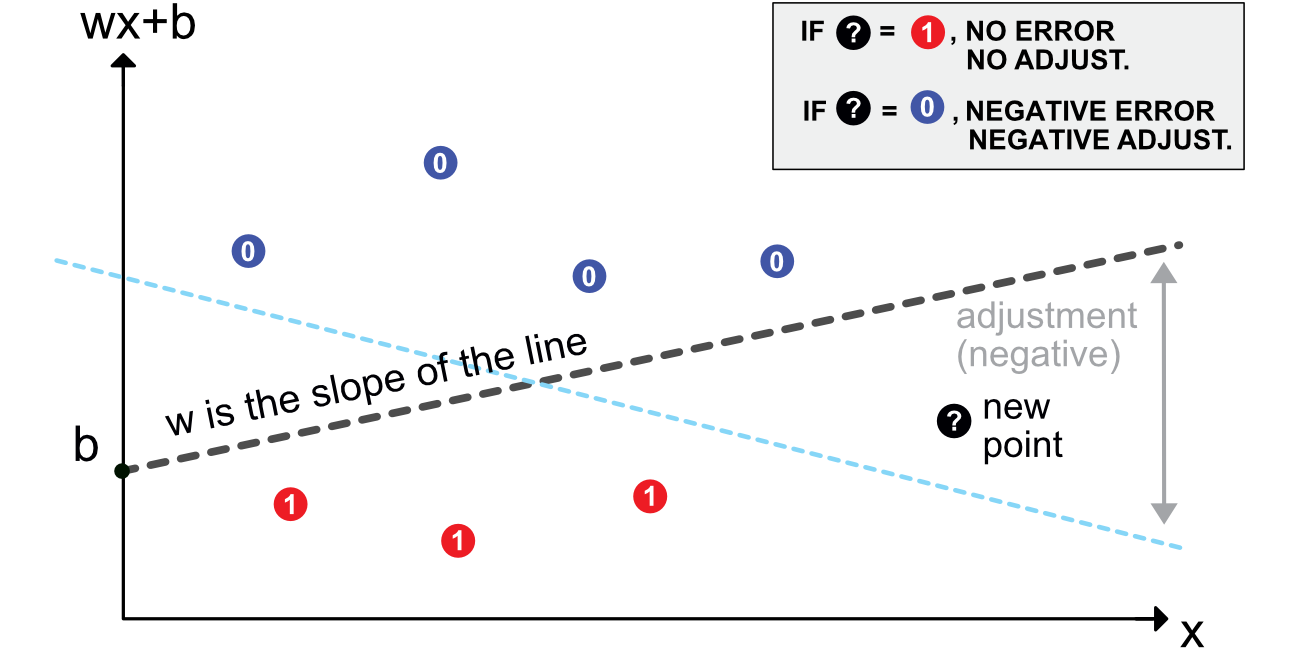

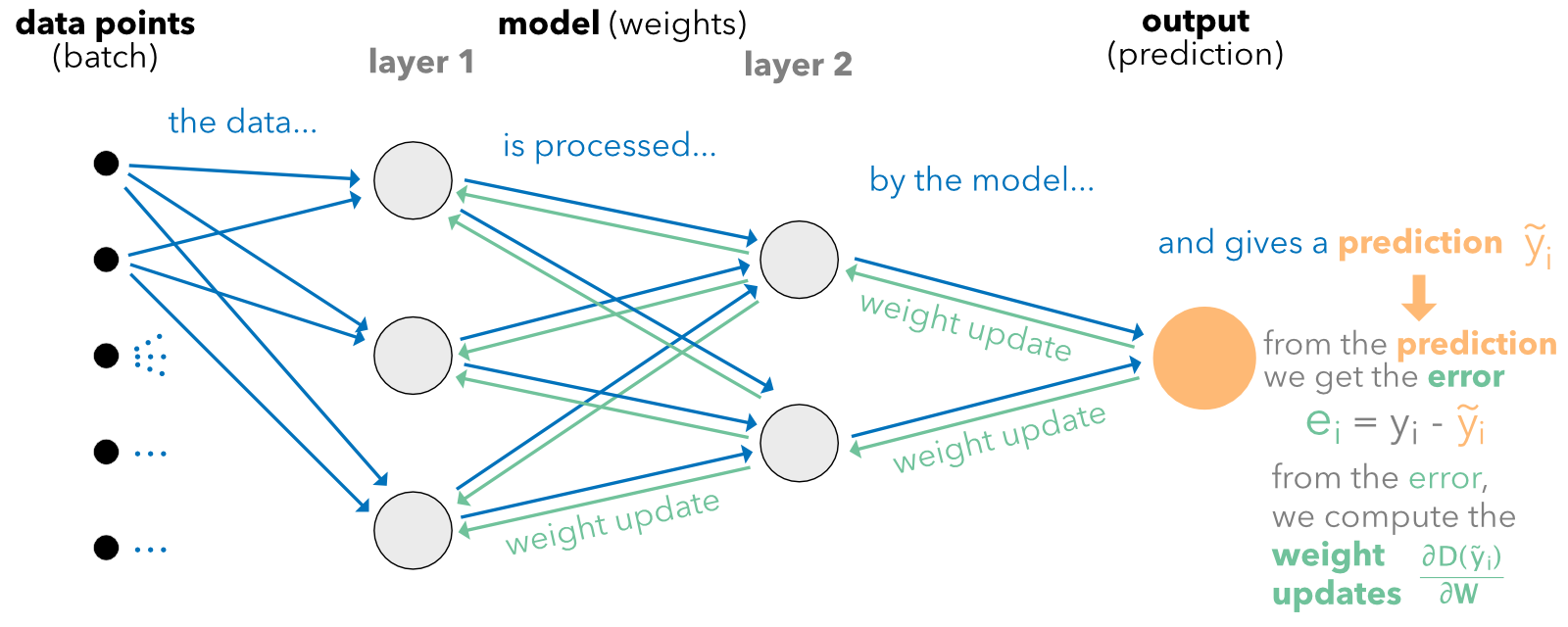

Just like for random forests with trees, the idea behind neural networks is to combine perceptron-like building blocks. A popular representation of neural networks is shown in Figure 7.2. This scheme is overly simplistic. It hides what is really going on: there is a perceptron in each green circle and each output is activated by some function before it is sent to the final output aggregation. This is why such a model is called a Multilayer Perceptron (MLP).

FIGURE 7.2: Simplified scheme of a multi-layer perceptron.

FIGURE 7.2: Simplified scheme of a multi-layer perceptron.

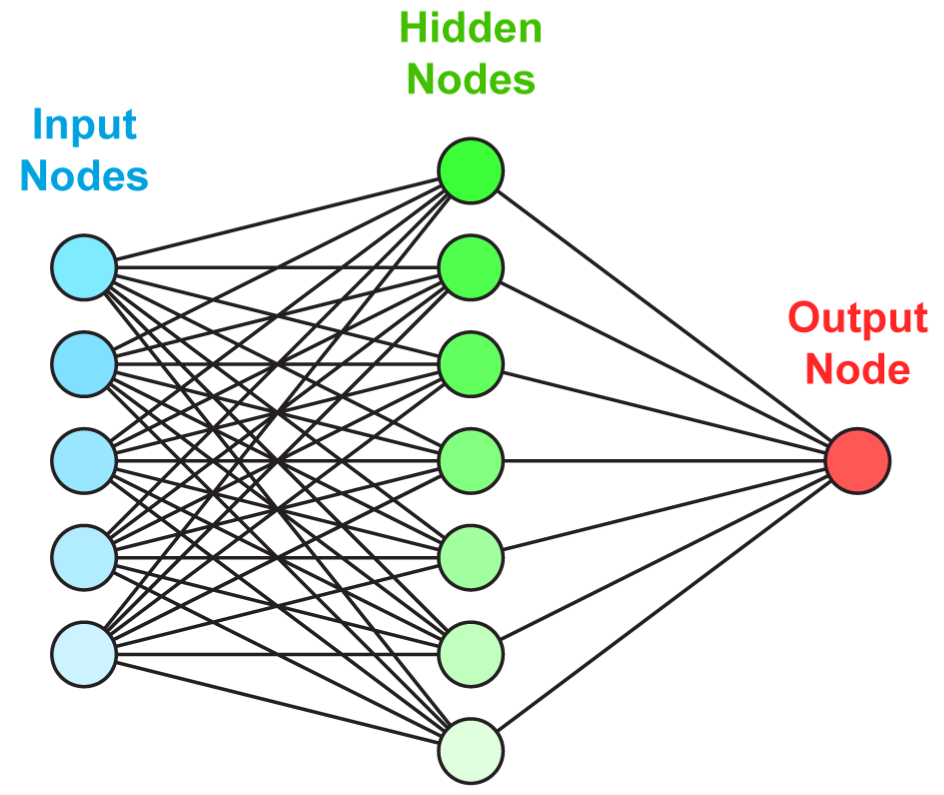

A more faithful account of what is going on is laid out in Figure 7.3.

FIGURE 7.3: Detailed scheme of a perceptron with 2 intermediate layers.

FIGURE 7.3: Detailed scheme of a perceptron with 2 intermediate layers.

Before we proceed with comments, we introduce some notation that will be used thoughout the chapter.

The process is the following. When entering the network, the data goes though the initial linear mapping:

which is then transformed by a non-linear function $f^{1}$. The result of this alteration is then given as input of the next layer and so on. The linear forms will be repeated (with different weights) for each layer of the network:

The connections between the layers are the so-called outputs, which are basically the linear mappings to which the activation functions $f^{(l)}$ have been applied. The output of layer $l$ is the input of layer $l+1$.

Finally, the terminal stage aggregates the outputs from the last layer:

In the forward-propagation of the input, the activation function naturally plays an important role. In Figure 7.4, we plot the most usual activation functions used by neural network libraries.

FIGURE 7.4: Plot of the most common activation functions.

FIGURE 7.4: Plot of the most common activation functions.

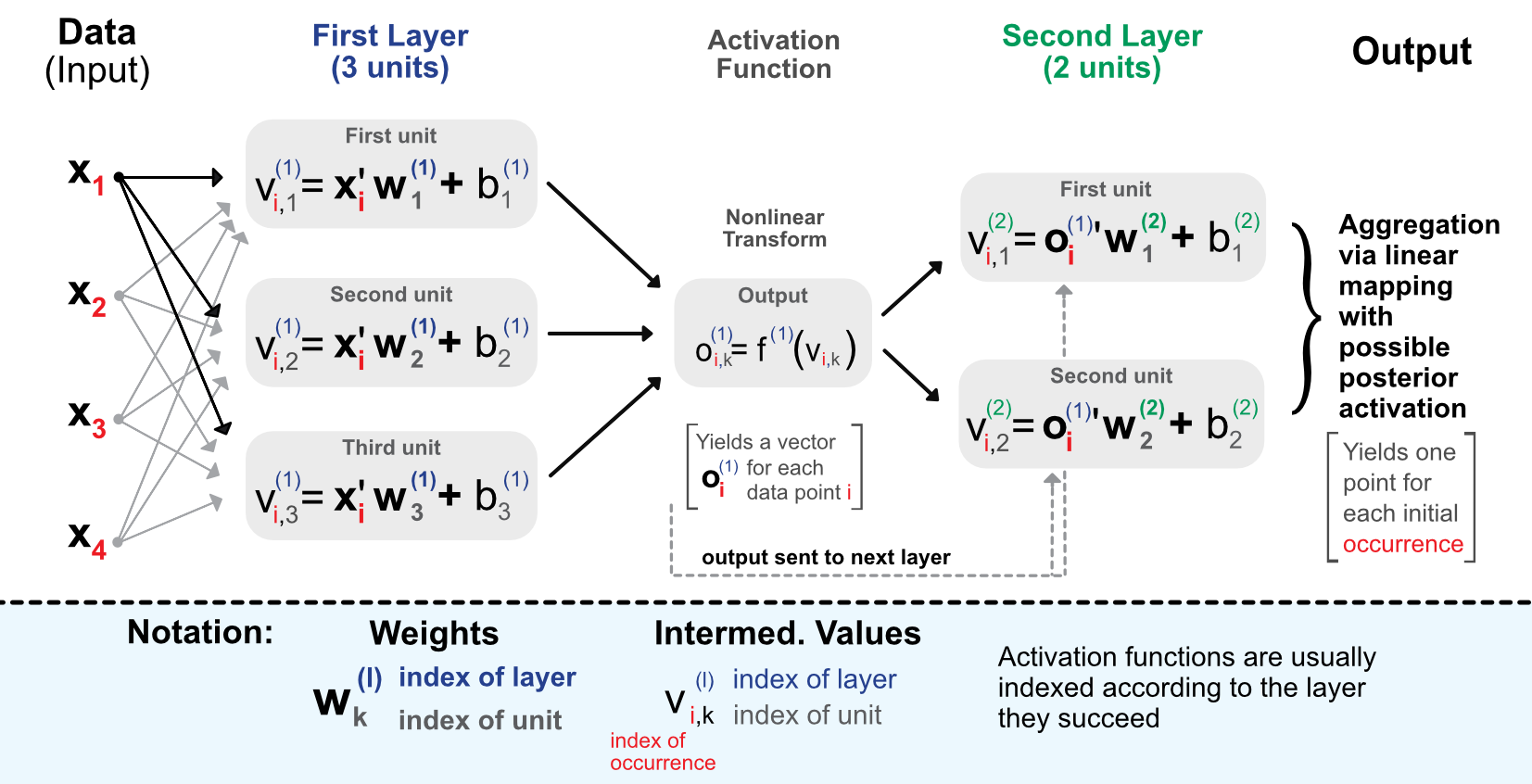

Let us rephrase the process through the lens of factor investing. The input $\textbf{x}$ are the characteristics of the firms. The first step is to multiply their value by weights and add a bias. This is performed for all the units of the first layer. The output, which is a linear combination of the input is then transformed by the activation function. Each unit provides one value and all of these values are fed to the second layer following the same process. This is iterated until the end of the network. The purpose of the last layer is to yield an output shape that corresponds to the label: if the label is numerical, the output is a single number, if it is categorical, then usually it is a vector with length equal to the number of categories. This vector indicates the probability that the value belongs to one particular category.

It is possible to use a final activation function after the output. This can have a huge importance on the result. Indeed, if the labels are returns, applying a sigmoid function at the very end will be disastrous because the sigmoid is always positive.

One reason neural networks work well is that they are universal approximators. Given any bounded continuous function, there exists a one-layer network that can approximate this function up to arbitrary precision (see Cybenko (1989) for early references, section 4.2 in Du and Swamy (2013) and section 6.4.1 in Goodfellow et al. (2016) for more exhaustive lists of papers, and Guliyev and Ismailov (2018) for recent results).

Formally, a one-layer perceptron is defined by

where $\phi$ is a (non-constant) bounded continuous function. Then, for any $\epsilon>0$, it is possible to find one $n$ such that for any continuous function $f$ on the unit hypercube $[0,1]^d$,

This result is rather intuitive: it suffices to add units to the layer to improve the fit. The process is more or less analogous to polynomial approximation, though some subtleties arise depending on the properties of the activations functions (boundedness, smoothness, convexity, etc.). We refer to Costarelli, Spigler, and Vinti (2016) for a survey on this topic.

The raw results on universal approximation imply that any well-behaved function $f$ can be approached sufficiently closely by a simple neural network, as long as the number of units can be arbitrarily large. Now, they do not directly relate to the learning phase, i.e., when the model is optimized with respect to a particular dataset. In a series of papers (Barron (1993) and Barron (1994), notably), Barron gives a much more precise characterization of what neural networks can achieve. In Barron (1993) it is for instance proved a more precise version of universal approximation: for particular neural networks (with sigmoid activation),$\mathbb{E}[(f(\textbf{x})-f_n(\textbf{x}))^2]\le c_f/n$, which gives a speed of convergence related to the size of the network. In the expectation, the random term is $x$: this corresponds to the case where the data is considered to be a sample of i.i.d. observations of a fixed distribution (this is the most common assumption in machine learning).

Below, we state one important result that is easy to interpret; it is taken from Barron (1994).

In the sequel,$f_n$ corresponds to a possibly penalized neural network with only one intermediate layer with $n$ units and sigmoid activation function. Moreover, both the supports of the predictors and the label are assumed to be bounded (which is not a major constraint). The most important metric in a regression exercise is the mean squared error (MSE) and the main result is a bound (in order of magnitude) on this quantity. For $N$ randomly sampled i.i.d. points $y_i=f(x_i)+\epsilon_i$ on which $f_n$ is trained, the best possible empirical MSE behaves like

where $K$ is the dimension of the input (number of columns) and $c_f$ is a constant that depends on the generator function $f$. The above quantity provides a bound on the error that can be achieved by the best possible neural network given a dataset of size $N$.

There are clearly two components in the decomposition of this bound. The first one pertains to the complexity of the network. Just as in the original universal approximation theorem, the error decreases with the number of units in the network. But this is not enough! Indeed, the sample size is of course a key driver in the quality of learning (of i.i.d. observations). The second component of the bound indicates that the error decreases at a slightly slower pace with respect to the number of observations ($\log(N)/N$) and is linear in the number of units and the size of the input. This clearly underlines the link (trade-off?) between sample size and model complexity: having a very complex model is useless if the sample is small just like a simple model will not catch the fine relationships in a large dataset.

Overall, a neural network is a possibly very complicated function with a lot of parameters. In linear regressions, it is possible to increase the fit by spuriously adding exogenous variables. In neural networks, it suffices to increase the number of parameters by arbitrarily adding units to the layer(s). This is of course a very bad idea because high-dimensional networks will mostly capture the particularities of the sample they are trained on.

Just like for tree methods, neural networks are trained by minimizing some loss function subject to some penalization:

where $\tilde{y}_i$ are the values obtained by the model and $y_i$ are the true values of the instances. A simple requirement that eases computation is that the loss function be differentiable. The most common choices are the squared error for regression tasks and cross-entropy for classification tasks. We discuss the technicalities of classification in the next subsection.

The training of a neural network amounts to alter the weights (and biases) of all units in all layers so that $O$ defined above is the smallest possible. To ease the notation and given that the $y_i$ are fixed, let us write $D(\tilde{y}_i(\textbf{W}))=\text{loss}(y_i,\tilde{y}_i)$, where $\textbf{W}$ denotes the entirety of weights and biases in the network. The updating of the weights will be performed via gradient descent, i.e., via

This mechanism is the most classical in the optimization literature and we illustrate it in Figure 7.5. We highlight the possible suboptimality of large learning rates. In the diagram, the descent associated with the high $\eta$ will oscillate around the optimal point, whereas the one related to the small eta will converge more directly.

The complicated task in the above equation is to compute the gradient (derivative) which tells in which direction the adjustment should be done. The problem is that the successive nested layers and associated activations require many iterations of the chain rule for differentiation.

FIGURE 7.5: Outline of gradient descent.

FIGURE 7.5: Outline of gradient descent.

The most common way to approximate a derivative is probably the finite difference method. Under the usual assumptions (the loss is twice differentiable), the centered difference satisfies:

where $h>0$ is some arbitrarily small number. In spite of its apparent simplicity, this method is costly computationally because it requires a number of operations of the magnitude of the number of weights.

Luckily, there is a small trick that can considerably ease and speed up the computation. The idea is to simply follow the chain rule and recycle terms along the way. Let us start by recalling

$\tilde{y}_i =f^{(L+1)} \left((\textbf{o}^{(L)}_i)'\textbf{w}^{(L+1)}+b^{(L+1)}\right)=f^{(L+1)}\left(b^{(L+1)}+\sum_{k=1}^{U_L} w^{(L+1)}_ko^{(L)}_{i,k} \right),$

so that if we differentiate with the most immediate weights and biases, we get:

This is the easiest part. We must now go back one layer and this can only be done via the chain rule. To access layer $L$, we recall identity $v_{i,k}^{(L)}=(\textbf{o}^{(L-1)}_i)'\textbf{w}^{(L)}_k+b_k^{(L)}=b_k^{(L)}+\sum_{j=1}^{U_L}o^{(L-1)}_{i,j}w^{(L)}_{k,j}$. We can then proceed:

where, as we show in the last line, one part of the derivative was already computed in the previous step (Equation (7.3)). Hence, we can recycle this number and only focus on the right part of the expression.

The magic of the so-called back-propagation is that this will hold true for each step of the differentiation. When computing the gradient for weights and biases in layer $l$, there will be two parts: one that can be recycled from previous layers and another, local part, that depends only on the values and activation function of the current layer. A nice illustration of this process is given by the Google developer team: playground.tensorflow.org.

When the data is formatted using tensors, it is possible to resort to vectorization so that the number of calls is limited to an order of the magnitude of the number of nodes (units) in the network.

The back-propagation algorithm can be summarized as follows. Given a sample of points (possibly just one):

FIGURE 7.6: Diagram of back-propagation.

FIGURE 7.6: Diagram of back-propagation.

This operation can be performed any number of times with different sample sizes. We discuss this issue in Section 7.3.

The learning rate $\eta$ can be refined. One option to reduce overfitting is to impose that after each epoch, the intensity of the update decreases. One possible parametric form is $\eta=\alpha e^{- \beta t}$, where $t$ is the epoch and $\alpha,\beta>0$. One further sophistication is to resort to so-called momentum (which originates from Polyak (1964)):

where $t$ is the index of the weight update. The idea of momentum is to speed up the convergence by including a memory term of the last adjustment $\textbf{m}_{t-1}$ and going in the same direction in the current update. The parameter $\gamma$ is often taken to be 0.9.

More complex and enhanced methods have progressively been developed:

Lastly, in some degenerate case, some gradients may explode and push weights far from their optimal values. In order to avoid this phenomenon, learning libraries implement gradient clipping. The user specifies a maximum magnitude for gradients, usually expressed as a norm. Whenever the gradient surpasses this magnitude, it is rescaled to reach the authorized threshold. Thus, the direction remains the same, but the adjustment is smaller.

In decision trees, the ultimate goal is to create homogeneous clusters, and the process to reach this goal was outlined in the previous chapter. For neural networks, things work differently because the objective is explicitly to minimize the error between the prediction $\tilde{\textbf{y}}_i$ and a target label $\textbf{y}_i$ . Again, here $\textbf{y}_i$ is a vector full of zeros with only one one denoting the class of the instance.

Facing a classification problem, the trick is to use an appropriate activation function at the very end of the network. The dimension of the terminal output of the network should be equal to $J$ (number of classes to predict), and if, for simplicity, we write $\textbf{x}_i$ for the values of this output, the most commonly used activation is the so-called softmax function:

The justification of this choice is straightforward: it can take any value as input (over the real line) and it sums to one over any (finite-valued) output. Similarly as for trees, this yields a ‘probability’ vector over the classes. Often, the chosen loss is a generalization of the entropy used for trees. Given the target label $\textbf{y}_i=(y_{i,1},\dots,y_{i,L})=(0,0,\dots,0,1,0,\dots,0)$ and the predicted output $\textbf{y}_i=(y_{i,1},\dots,y_{i,L})=(0,0,\dots,0,1,0,\dots,0)$ , the cross-entropy is defined as

Basically, it is a proxy of the dissimilarity between its two arguments. One simple interpretation is the following. For the nonzero label value, the loss is $-\log(\tilde{y}_{i,l})$, while for all others, it is zero. In the log, the loss will be minimal if $\tilde{y}_{i,l}=1$, which is exactly what we seek (i.e.,$y_{i,l}=\tilde{y}_{i,l}$ ). In applications, this best case scenario will not happen, and the loss will simply increase when $\tilde{y}_{i,l}$ drifts away downwards from one.

Beyond the ones presented in the previous sections, the user faces many degrees of freedom when building a neural network. We present a few classical choices that are available when constructing and training neural networks.

Arguably, the first choice pertains to the structure of the network. Beyond the dichotomy feed-forward versus recurrent (see Section 7.5), the immediate question is: how big (or how deep) the networks should be. First of all, let us calculate the number of parameters (i.e., weights plus biases) that are estimated (optimized) in a network.

As in any model, the number of parameters should be much smaller than the number of instances. There is no fixed ratio, but it is preferable if the sample size is at least ten times larger than the number of parameters. Below a ratio of 5, the risk of overfitting is high. Given the amount of data readily available, this constraint is seldom an issue, unless one wishes to work with a very large network.

The number of hidden layers in current financial applications rarely exceeds three or four. The number of units per layer $(U_k)$ is often chosen to follow the geometric pyramid rule (see, e.g., Masters (1993)). If there are $L$ hidden layers, with $I$ features in the input and $O$ dimensions in the output (for regression tasks, $O=1$), then, for the $k^{th}$ layer, a rule of thumb for the number of units is

If there is only one intermediate layer, the recommended proxy is the integer part of $\sqrt{IO}$. If not, the network starts with many units and the number of unit decreases exponentially towards the output size. Often, the number of layers is a power of two because, in high dimensions, networks are trained on Graphics Processing Units (GPUs) or Tensor Processing Units (TPUs). Both pieces of hardware can be used optimally when the inputs have sizes equals to powers of two.

Several studies have shown that very large architectures do not always perform better than more shallow ones (e.g., Gu, Kelly, and Xiu (2020b) and Orimoloye et al. (2019) for high frequency data, i.e., not factor-based). As a rule of thumb, a maximum of three hidden layers seem to be sufficient for prediction purposes.

In the expression (7.2), it is implicit that the computation is performed for one given instance. If the sample size is very large (hundreds of thousands or millions of instances), updating the weights according to each point is computationally too costly. The updating is then performed on groups of instances which are called batches. The sample is (randomly) split into batches of fixed sizes and each update is performed following the rule:

The change in weights is computed over the average loss computed over all instances in the batch. The terminology for training includes:

When the batch is equal to only one instance, the method is referred to as ‘stochastic gradient descent’ (SGD): the instance is chosen randomly. When the batch size is strictly above one and below the total number of instances, the learning is performed via ‘mini’ batches, that is, small groups of instances. The batches are also chosen randomly, but without replacement in the sample because for one epoch, the union of batches must be equal to the full training sample.

It is impossible to know in advance what a good number of epochs is. Sometimes, the network stops learning after just 5 epochs (the validation loss does not decrease anymore). In some cases when the validation sample is drawn from a distribution close to that of the training sample, the network continues to learn even after 200 epochs. It is up to the user to test different values to evaluate the learning speed. In the examples below, we keep the number of epochs low for computational purposes.

At each level (layer), it is possible to enforce constraints or penalizations on the weights (and biases). Just as for tree methods, this helps slow down the learning to prevent overfitting on the training sample. Penalizations are enforced directly on the loss function and the objective function takes the form

where the subscripts $k$ and $j$ pertain to the weights to which the $L^1$ and (or) $L^2$ penalization is applied.

In addition, specific constraints can be enforced on the weights directly during the training. Typically, two types of constraints are used:

Lastly, another (somewhat exotic) way to reduce the risk of overfitting is simply to reduce the size (number of parameters) of the model. Srivastava et al. (2014) propose to omit units during training (hence the term ‘dropout’). The weights of randomly chosen units are set to zero during training. All links from and to the unit are ignored, which mechanically shrinks the network. In the testing phase, all units are back, but the values (weights) must be scaled to account for the missing activations during the training phase.

The interested reader can check the advice compiled in Bengio (2012), Hanin and Rolnick (2018), and Smith (2018) for further tips on how to configure neural networks. A paper dedicated to hyperparameter tuning for stock return prediction is Lee (2020).

There are several frameworks and libraries that allow robust and flexible constructions of neural networks. Among them, Keras and Tensorflow (developed by Google) are probably the most used at the time we write this book (PyTorch, from Facebook, is one alternative). For simplicity and because we believe it is the best choice, we implement the NN with Keras (which is the high level API of Tensorflow, see https://www.tensorflow.org). The original Python implementation is referenced on https://keras.io.

In this section, we provide a detailed (though far from exhaustive) account of how to train neural networks with Keras. For the sake of completeness, we proceed in two steps. The first one relates to a very simple regression exercise. Its purpose is to get the reader familiar with the syntax of Keras. In the second step, we lay out many of the options proposed by Keras to perform a classification exercise. With these two examples, we thus cover most of the mainstream topics falling under the umbrella of feed-forward multilayered perceptrons.

Before we head to the core of the NN, a short stage of data preparation is required. Just as for penalized regressions and boosted trees, the data must be sorted into four parts which are the combination of two dichotomies: training versus testing and labels versus features. We define the corresponding variables below. For simplicity, the first example is a regression exercise. A classification task will be detailed below.

import tensorflow as tf

from plot_keras_history import show_history, plot_history

NN_train_features = training_sample[features].values # Training features

NN_train_labels = training_sample['R1M_Usd'].values # Training labels

NN_test_features = testing_sample[features].values # Testing features

NN_test_labels = testing_sample['R1M_Usd'].values # Testing labels

In Keras, the training of neural networks is performed through three steps:

We start with a very simple architecture with two hidden layers.

from tensorflow import keras

from tensorflow.keras import layers

model = keras.Sequential()

model.add(layers.Dense(16, activation="relu", input_shape=(len(features),)))

model.add(layers.Dense(8, activation="tanh"))

model.add(layers.Dense(1))

The definition of the structure is very intuitive and uses the sequential syntax in which one input is iteratively transformed by a layer until the last iteration which gives the output. Each layer depends on two parameters: the number of units and the activation function that is applied to the output of the layer. One important point is the input_shape parameter for the first layer. It is required for the first layer and is equal to the number of features. For the subsequent layers, the input_shape is dictated by the number of units of the previous layer; hence it is not required. The activations that are currently available are listed on https://keras.io/activations/. We use the hyperbolic tangent in the second-to-last layer because it yields both positive and negative outputs. Of course, the last layer can generate negative values as well, but it’s preferable to satisfy this property one step ahead of the final output.

model.compile(optimizer='RMSprop',

loss='mse',

metrics=['MeanAbsoluteError'])

model.summary()

Model: "sequential_1"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

dense_3 (Dense) (None, 16) 1504

dense_4 (Dense) (None, 8) 136

dense_5 (Dense) (None, 1) 9

=================================================================

Total params: 1,649

Trainable params: 1,649

Non-trainable params: 0

_________________________________________________________________

The summary of the model lists the layers in their order from input to output (forward pass). Because we are working with 93 features, the number of parameters for the first layer (16 units) is 93 plus one (for the bias) multiplied by 16, which makes 1504. For the second layer, the number of inputs is equal to the size of the output from the previous layer (16). Hence given the fact that the second layer has 8 units, the total number of parameters is (16+1)*8 = 136.

We set the loss function to the standard mean squared error. Other losses are listed on https://keras.io/losses/, some of them work only for regressions (MSE, MAE) and others only for classification (categorical cross-entropy, see Equation (7.5)). The RMS propragation optimizer is the classical mini-batch back-propagation implementation. For other weight updating algorithms, we refer to https://keras.io/optimizers/. The metric is the function used to assess the quality of the model. It can be different from the loss: for instance, using entropy for training and accuracy as the performance metric.

The final stage fits the model to the data and requires some additional training parameters:

fit_NN = model.fit(

NN_train_features,

NN_train_labels,

batch_size=256,

epochs = 10,

validation_data=(NN_test_features,NN_test_labels),

verbose = True

)

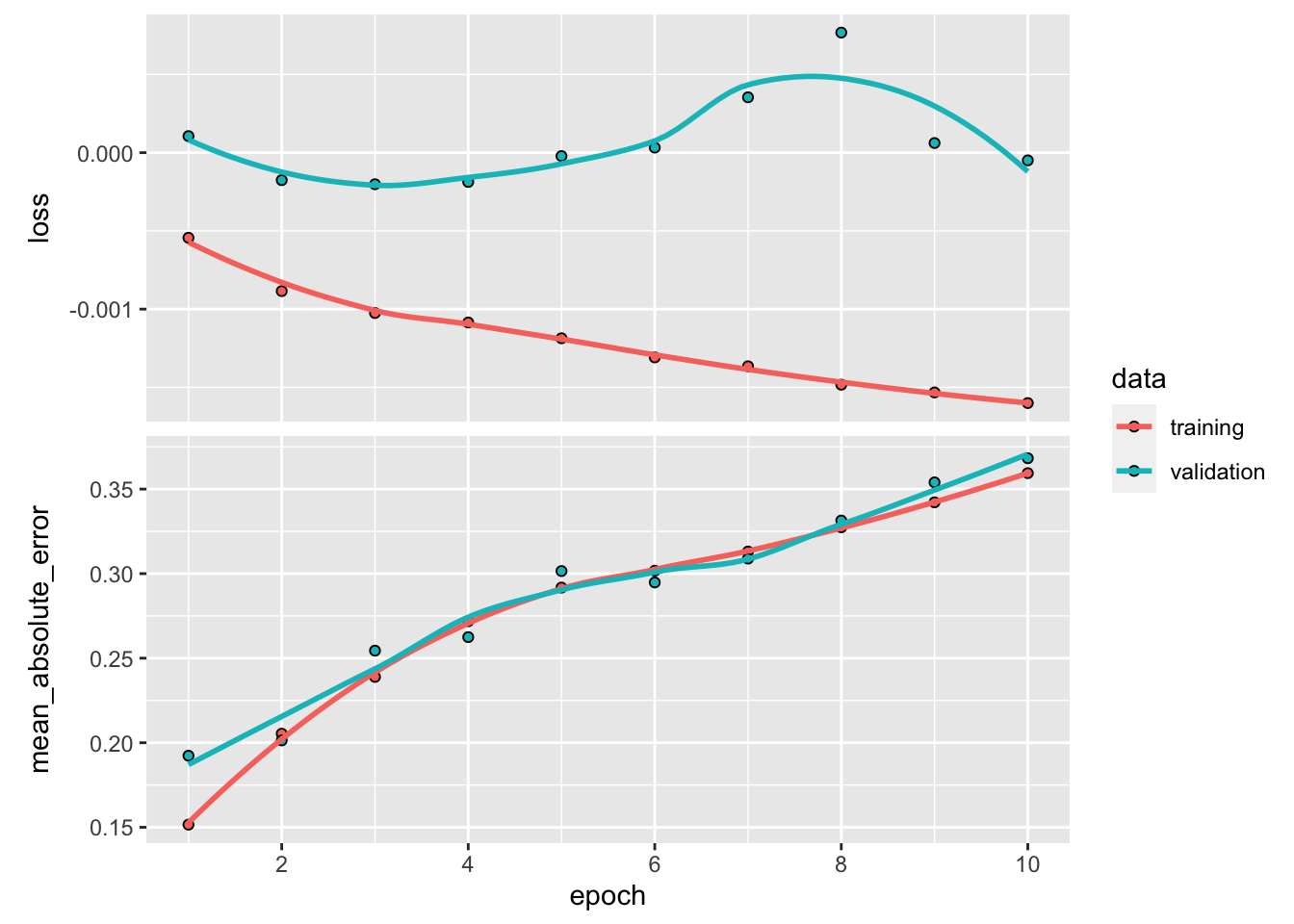

show_history(fit_NN) # Plot, evidently!

Epoch 1/10 774/774 [==============================] - 1s 962us/step - loss: 0.0289 - mean_absolute_error: 0.0839 - val_loss: 0.0371 - val_mean_absolute_error: 0.0670 Epoch 2/10 774/774 [==============================] - 1s 950us/step - loss: 0.0289 - mean_absolute_error: 0.0838 - val_loss: 0.0370 - val_mean_absolute_error: 0.0667 Epoch 3/10 774/774 [==============================] - 1s 947us/step - loss: 0.0289 - mean_absolute_error: 0.0839 - val_loss: 0.0371 - val_mean_absolute_error: 0.0672 Epoch 4/10 774/774 [==============================] - 1s 912us/step - loss: 0.0289 - mean_absolute_error: 0.0839 - val_loss: 0.0370 - val_mean_absolute_error: 0.0669 Epoch 5/10 774/774 [==============================] - 1s 920us/step - loss: 0.0289 - mean_absolute_error: 0.0839 - val_loss: 0.0370 - val_mean_absolute_error: 0.0671 Epoch 6/10 774/774 [==============================] - 1s 919us/step - loss: 0.0288 - mean_absolute_error: 0.0839 - val_loss: 0.0372 - val_mean_absolute_error: 0.0679 Epoch 7/10 774/774 [==============================] - 1s 917us/step - loss: 0.0288 - mean_absolute_error: 0.0839 - val_loss: 0.0372 - val_mean_absolute_error: 0.0677 Epoch 8/10 774/774 [==============================] - 1s 1ms/step - loss: 0.0288 - mean_absolute_error: 0.0839 - val_loss: 0.0370 - val_mean_absolute_error: 0.0668 Epoch 9/10 774/774 [==============================] - 1s 912us/step - loss: 0.0289 - mean_absolute_error: 0.0839 - val_loss: 0.0372 - val_mean_absolute_error: 0.0680 Epoch 10/10 774/774 [==============================] - 1s 908us/step - loss: 0.0288 - mean_absolute_error: 0.0839 - val_loss: 0.0370 - val_mean_absolute_error: 0.0666

The batch size is quite arbitrary. For technical reasons pertaining to training on GPUs, these sizes are often powers of 2.

In Keras, the plot of the trained model shows four different curves (shown here in Figure 7.7). The top graph displays the improvement (or lack thereof) in loss as the number of epochs increases. Usually, the algorithm starts by learning rapidly and then converges to a point where any additional epoch does not improve the fit. In the example above, this point arrives rather quickly because it is hard to notice any gain beyond the fourth epoch. The two colors show the performance on the two samples: the training sample and the testing sample. By construction, the loss will always improve (even marginally) on the training sample. When the impact is negligible on the testing sample (the curve is flat, as is the case here), the model fails to generalize out-of-sample: the gains obtained by training on the original sample do not translate to gains on previously unseen data; thus, the model seems to be learning noise.

The second graph shows the same behavior but is computed using the metric function. The correlation (in absolute terms) between the two curves (loss and metric) is usually high. If one of them is flat, the other should be as well.

In order to obtain the parameters of the model, the user can call get_weights(model).18 We do not execute the code here because the size of the output is much too large, as there are thousands of weights.

Finally, from a practical point of view, the prediction is obtained via the usual predict() function. We use this function below on the testing sample to calculate the hit ratio.

hitratio = np.mean(model.predict(NN_test_features) * NN_test_labels > 0)

print(f'Hit Ratio: {hitratio}')

Hit Ratio: 0.5416737440003773

Again, the hit ratio lies between 50% and 55%, which seems reasonably good. Most of the time, neural networks have their weights initialized randomly. Hence, two independently trained networks with the same architecture and same training data may well lead to very different predictions and performance! One way to bypass this issue is to freeze the random number generator. Models can also be easily exchanged by loading weights via the set_weights() function.

We pursue our exploration of neural networks with a much more detailed example. The aim is to carry out a classification task on the binary label R1M_Usd_C. Before we proceed, we need to format the label properly. To this purpose, we resort to one-hot encoding (see Section 4.5.2).

from tensorflow.keras.utils import to_categorical

NN_train_labels_C = to_categorical(training_sample['R1M_Usd_C'].values) # One-hot encoding of the label

NN_test_labels_C = to_categorical(testing_sample['R1M_Usd_C'].values) # One-hot encoding of the label

The labels NN_train_labels_C and NN_test_labels_C have two columns: the first flags the instances with above median returns and the second flags those with below median returns. Note that we do not alter the feature variables: they remain unchanged. Below, we set the structure of the networks with many additional features compared to the first one.

from tensorflow.keras import initializers

from tensorflow.keras.constraints import non_neg

# Usage in a Keras layer:

initializer =initializers.RandomNormal()

model_C = keras.Sequential() # This defines the structure of the network, i.e. how layers are organized

model_C.add(layers.Dense(16, activation="tanh", # Nb units & activation

input_shape=(len(features),), # Size of input

kernel_initializer=initializer, # Initialization of weights

kernel_constraint = non_neg())) # Weights should be nonneg

model_C.add(layers.Dropout(.25)) # Dropping out 25% units

model_C.add(layers.Dense(8, activation="elu", # Nb units & activation

bias_initializer = initializers.Constant(0.2), # Initialization of biases

kernel_regularizer='l2')) # Penalization of weights

model_C.add(layers.Dense(2,activation='softmax')) # Softmax for categorical output

Before we start commenting on the many options used above, we highlight that Keras models, unlike many R variables, are mutable objects. This means that any piping %>% after calling a model will alter it. Hence, successive trainings do not start from scratch but from the result of the previous training.

First, the options used above and below were chosen as illustrative examples and do not serve to particularly improve the quality of the model. The first change compared to Section 7.4.1 is the activation functions. The first two are simply new cases, while the third one (for the output layer) is imperative. Indeed, since the goal is classification, the dimension of the output must be equal to the number of categories of the labels. The activation that yields a multivariate is the softmax function. Note that we must also specify the number of classes (categories) in the terminal layer.

The second major innovation is options pertaining to parameters. One family of options deals with the initialization of weights and biases. In Keras, weights are referred to as the ‘kernel’. The list of initializers is quite long and we suggest the interested reader has a look at the Keras reference (https://keras.io/initializers/). Most of them are random, but some of them are constant.

Another family of options is the constraints and norm penalization that are applied on the weights and biases during training. In the above example, the weights of the first layer are coerced to be non-negative, while the weights of the second layer see their magnitude penalized by a factor (0.01) times their $L^2$ norm.

Lastly, the final novelty is the dropout layer (see Section 7.3.3) between the first and second layers. According to this layer, one fourth of the units in the first layer will be (randomly) omitted during training.

The specification of the training is outlined below.

model_C.compile( # Model specification

optimizer=keras.optimizers.Adam(

learning_rate=0.01, # Optimisation method (weight updating)

beta_1 = 0.9, # The exponential decay rate for the 1st moment estimates

beta_2 = 0.95), # The exponential decay rate for the 2nd moment estimates

loss=keras.losses.BinaryCrossentropy(from_logits=True), # Loss function

metrics=['categorical_accuracy']) # Output metric

model_C.summary() # Model structure

Model: "sequential_2"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

dense_6 (Dense) (None, 16) 1504

dropout (Dropout) (None, 16) 0

dense_7 (Dense) (None, 8) 136

dense_8 (Dense) (None, 2) 18

=================================================================

Total params: 1,658

Trainable params: 1,658

Non-trainable params: 0

_________________________________________________________________

Here again, many changes have been made: all levels have been revised. The loss is now the cross-entropy. Because we work with two categories, we resort to a specific choice (binary cross-entropy), but the more general form is the option categorical_crossentropy and works for any number of classes (strictly above 1). The optimizer is also different and allows for several parameters and we refer to Kingma and Ba (2014). Simply put, the two beta parameters control decay rates for exponentially weighted moving averages used in the update of weights. The two averages are estimates for the first and second moment of the gradient and can be exploited to increase the speed of learning. The performance metric in the above chunk is the categorical accuracy. In multiclass classification, the accuracy is defined as the average accuracy over all classes and all predictions. Since a prediction for one instance is a vector of weights, the ‘terminal’ prediction is the class that is associated with the largest weight. The accuracy then measures the proportion of times when the prediction is equal to the realized value (i.e., when the class is correctly guessed by the model).

Finally, we proceed with the training of the model.

callback = tf.keras.callbacks.EarlyStopping(monitor = "val_loss", # Early stopping:

min_delta = 0.001, # Improvement threshold

patience = 4, # Nb epochs with no improvmt

verbose = 0 ) # No warnings

fit_NN_C = model_C.fit(

NN_train_features, # Training features

NN_train_labels_C, # Training labels

batch_size=512, # Training parameters

epochs = 20, # Training parameters

validation_data=(NN_test_features,NN_test_labels_C), # Test data

verbose = True, # No comments from algo

callbacks=[callback] # see callback above

)

show_history(fit_NN_C)

Epoch 1/20

C:\Users\TGU.RAMAI\Anaconda3\lib\site-packages\tensorflow\python\util\dispatch.py:1096: UserWarning: "`binary_crossentropy` received `from_logits=True`, but the `output` argument was produced by a sigmoid or softmax activation and thus does not represent logits. Was this intended?" return dispatch_target(*args, **kwargs)

387/387 [==============================] - 1s 2ms/step - loss: 0.6993 - categorical_accuracy: 0.5030 - val_loss: 0.6938 - val_categorical_accuracy: 0.4963 Epoch 2/20 387/387 [==============================] - 1s 1ms/step - loss: 0.6934 - categorical_accuracy: 0.5004 - val_loss: 0.6932 - val_categorical_accuracy: 0.5037 Epoch 3/20 387/387 [==============================] - 1s 1ms/step - loss: 0.6933 - categorical_accuracy: 0.5017 - val_loss: 0.6931 - val_categorical_accuracy: 0.5037 Epoch 4/20 387/387 [==============================] - 1s 1ms/step - loss: 0.6933 - categorical_accuracy: 0.5007 - val_loss: 0.6932 - val_categorical_accuracy: 0.4963 Epoch 5/20 387/387 [==============================] - 1s 1ms/step - loss: 0.6934 - categorical_accuracy: 0.5014 - val_loss: 0.6932 - val_categorical_accuracy: 0.5037

FIGURE 7.8: Output from a trained neural network (classification task) with early stopping.

There is only one major difference here compared to the previous training call. In Keras, callbacks are functions that can be used at given stages of the learning process. In the above example, we use one such function to stop the algorithm when no progress has been made for some time.

When datasets are large, the training can be long, especially when batch sizes are small and/or the number of epochs is high. It is not guaranteed that going to the full number of epochs is useful, as the loss or metric functions may be plateauing much sooner. Hence, it can be very convenient to stop the process if no improvement is achieved during a specified time-frame. We set the number of epochs to 20, but the process will likely stop before that.

In the above code, the improvement is focused on validation accuracy (“val_loss”; one alternative is “val_acc”). The min_delta value sets the minimum improvement that needs to be attained for the algorithm to continue. Therefore, unless the validation accuracy gains 0.001 points at each epoch, the training will stop. Nevertheless, some flexibility is introduced via the patience parameter, which in our case asserts that the halting decision is made only after three consecutive epochs with no improvement. In the option, the verbose parameter dictates the amount of comments that is made by the function. For simplicity, we do not want any comments, hence this value is set to zero.

In Figure 7.8, the two graphs yield very different curves. One reason for that is the scale of the second graph. The range of accuracies is very narrow. Any change in this range does not represent much variation overall. The pattern is relatively clear on the training sample: the loss decreases, while the accuracy improves. Unfortunately, this does not translate to the testing sample which indicates that the model does not generalize well out-of-sample.

In Keras, it is possible to define user-specified loss functions. This may be interesting in some cases. For instance, the quadratic error has three terms

$y_i^2$,$\tilde{y}_i^2$ and $-2y_i\tilde{y}_i$. In practice, it can make sense to focus more on the latter term because it is the most essential: we do want predictions and realized values to have the same sign! Below we show how to optimize on a simple (product) function in Keras,$l(y_i,\tilde{y}_i)=(\tilde{y}_i-\tilde{m})^2-\gamma (y_i-m)(\tilde{y}_i-\tilde{m})$, where

$m$ and $\tilde{m}$ are the sample averages of $\tilde{m}$ and $\tilde{y}_i$. With $\gamma>2$, we give more weight to the cross term. We start with a simple architecture.

model_custom = keras.Sequential() # this defines the structure of the network, i.e. how layers are organised

model_custom.add(layers.Dense(16, activation="relu", input_shape=(len(features),)))

model_custom.add(layers.Dense(8, activation="sigmoid"))

model_custom.add(layers.Dense(1)) # No activation means linear activation: f(x) = x

Then we code the loss function and integrate it to the model. The important trick is to resort to functions that are specific to the library (the k_functions). We code the variance of predicted values minus the scaled covariance between realized and predicted values. Below we use a scale of five.

def custom_loss(y_true, y_pred): # Defines the loss, we use gamma = 5

loss = tf.reduce_mean(tf.square(y_pred - tf.reduce_mean(y_pred))) - 5 * tf.reduce_mean(

(y_true - tf.reduce_mean(y_true))*(y_pred - tf.reduce_mean(y_pred)))

return loss

model_custom.compile( # Model specification

optimizer='RMSprop', # Optim method

loss=custom_loss, # New loss function

metrics=['MeanAbsoluteError'])

Finally, we are ready to train and briefly evaluate the performance of the model.

fit_NN_cust = model_custom.fit(

NN_train_features, # training features

NN_train_labels, # Training labels

batch_size=512, epochs = 10, # Training parameters

validation_data=(NN_test_features,NN_test_labels), # Test data

verbose = False) # No warnings

show_history(fit_NN_cust)

hitratio = np.mean(model_custom.predict(NN_test_features) * NN_test_labels > 0) # Hit ratio

print(f'Hit Ratio: {hitratio}')

Hit Ratio: 0.44688639471285324

The outcome could be improved. There are several directions that could help. One of them is arguably that the model should be dynamic and not static (see Chapter 12).

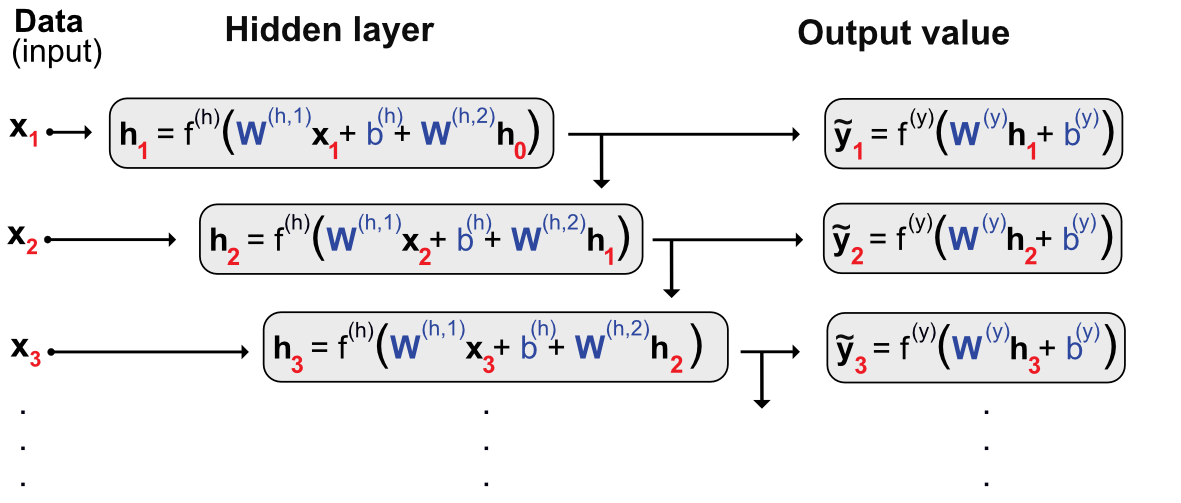

Multilayer perceptrons are feed-forward networks because the data flows from left to right with no looping in between. For some particular tasks with sequential linkages (e.g., time-series or speech recognition), it might be useful to keep track of what happened with the previous sample (i.e., there is a natural ordering). One simple way to model ‘memory’ would be to consider the following network with only one intermediate layer:

where $h_0$ is customarily set at zero (vector-wise).

These kinds of models are often referred to as Elman (1990) models or to Jordan (1997) models if in the latter case $h_{i-1}$ is replaced by $y_{i-1}$ in the computation of $h_i$. Both types of models fall under the overarching umbrella of Recurrent Neural Networks (RNNs).

The $h_i$ is usually called the state or the hidden layer. The training of this model is complicated and must be done by unfolding the network over all instances to obtain a simple feed-forward network and train it regularly. We illustrate the unfolding principle in Figure 7.9. It shows a very deep network. The first input impacts the first layer and then the second one via $h_1$ and all following layers in the same fashion. Likewise, the second input impacts all layers except the first and each instance $i-1$ is going to impact the output $\tilde{y}_i$ and all outputs $\tilde{y}_j$ for $j \ge i$. In Figure 7.9, the parameters that are trained are shown in blue. They appear many times, in fact, at each level of the unfolded network.

FIGURE 7.9: Unfolding a recurrent network.

FIGURE 7.9: Unfolding a recurrent network.

The main problem with the above architecture is the loss of memory induced by vanishing gradients. Because of the depth of the model, the chain rule used in the back-propagation will imply a large number of products of derivatives of activation functions. Now, as is shown in Figure 7.4, these functions are very smooth and their derivatives are most of the time smaller than one (in absolute value). Hence, multiplying many numbers smaller than one leads to very small figures: beyond some layers, the learning does not propagate because the adjustments are too small.

One way to prevent this progressive discounting of the memory was introduced in Hochreiter and Schmidhuber (1997) (Long-Short Term Memory - LSTM model). This model was subsequently simplified by the authors Chung et al. (2015) and we present this more parsimonious model below. The Gated Recurrent Unit (GRU) is a slightly more complicated version of the vanilla recurrent network defined above. It has the following representation:

In compact form, this gives

where the $z_i$ decides the optimal mix between the current and past values. For the candidate value, $r_i$ decides which amount of past/memory to retain. $r_i$ is commonly referred to as the ‘reset gate’ and $z_i$ to the ‘update gate’.

There are some subtleties in the training of a recurrent network. Indeed, because of the chaining between the instances, each batch must correspond to a coherent time series. A logical choice is thus one batch per asset with instances (logically) chronologically ordered. Lastly, one option in some frameworks is to keep some memory between the batches by passing the final value of $\tilde{y}_i$ to the next batch (for which it will be $\tilde{y}_0$). This is often referred to as the stateful mode and should be considered meticulously. It does not seem desirable in a portfolio prediction setting if the batch size corresponds to all observations for each asset: there is no particular link between assets. If the dataset is divided into several parts for each given asset, then the training must be handled very cautiously.

Reccurrent networks and LSTM especially have been found to be good forecasting tools in financial contexts (see, e.g., Fischer and Krauss (2018) and Wang et al. (2020)).

Recurrent networks are theoretically more complicated compared to multilayered perceptrons. In practice, they are also more challenging in their implementation. Indeed, the serial linkages require more attention compared to feed-forward architectures. In an asset pricing framework, we must separate the assets because the stock-specific time series cannot be bundled together. The learning will be sequential, one stock at a time.

The dimensions of variables are crucial. In Keras, they are defined for RNNs as:

For simplicity and in order to reduce computation times, we will use the same subset of stocks as that from Section 5.2.2. This yields a perfectly rectangular dataset in which all dates have the same number of observations.

First, we create some new, intermediate variables.

data_rnn = data_ml[data_ml['stock_id'].isin(stock_ids_short)] # Dedicated dataset

training_sample_rnn = data_rnn[data_rnn['date'] < separation_date] # Training set

testing_sample_rnn = data_rnn[data_rnn['date'] > separation_date] # Test set

nb_stocks = len(stock_ids_short) # Nb stocks

nb_feats = len(features) # Nb features

nb_dates_train = training_sample_rnn.shape[0] // nb_stocks # Nb training dates

nb_dates_test = testing_sample_rnn.shape[0] // nb_stocks # Nb testing dates

nn_train_features = training_sample_rnn[features].values # Train features in array format

nn_test_features = testing_sample_rnn[features].values # Test features in array format

nn_train_labels = training_sample_rnn['R1M_Usd'].values # Train label in array format

nn_test_labels = testing_sample_rnn['R1M_Usd'].values # Test label in array format

Then, we construct the variables we will pass as arguments. We recall that the data file was ordered first by stocks and then by date (see Section 1.2).

train_features_rnn = np.reshape(nn_train_features, # Formats the training data into tricky ordered array

(nb_stocks, nb_dates_train, nb_feats)) # The order is: stock, date, feature

test_features_rnn = np.reshape(nn_test_features, # Formats the training data into tricky ordered array

(nb_stocks, nb_dates_test, nb_feats)) # The order is: stock, date, feature

train_labels_rnn = np.reshape(nn_train_labels, (nb_stocks, nb_dates_train, 1))

test_labels_rnn = np.reshape(nn_test_labels, (nb_stocks, nb_dates_test, 1))

Finally, we move towards the training part. For simplicity, we only consider a simple RNN with only one layer. The structure is outlined below. In terms of recurrence structure, we pick a Gated Recurrent Unit (GRU).

model_RNN = keras.Sequential()

model_RNN.add(layers.GRU(16, # Nb units in hidden layer

batch_input_shape = (nb_stocks, nb_dates_train, nb_feats), # Dimensions = tricky part

activation='tanh', # Activation function

return_sequences=True)) # Return all the sequence

model_RNN.add(layers.Dense(1)) # Final aggregation layer

model_RNN.compile(optimizer='RMSprop', # Loss = quadratic

loss='mse', # Backprop

metrics=['MeanAbsoluteError']) # Output metric MAE

There are many options available for recurrent layers. For GRUs, we refer to the Keras documentation https://keras.rstudio.com/reference/layer_gru.html. We comment briefly on the option return_sequences which we activate. In many cases, the output is simply the terminal value of the sequence. If we do not require the entirety of the sequence to be returned, we will face a problem in the dimensionality because the label is indeed a full sequence. Once the structure is determined, we can move forward to the training stage.

fit_RNN = model_RNN.fit(train_features_rnn, # Training features

train_labels_rnn, # Training labels

epochs = 10, # Number of rounds

batch_size = nb_stocks, # Length of sequences

verbose=False) # No warnings

show_history(fit_RNN)

FIGURE 7.10: Output from a trained recurrent neural network (regression task).

Compared to our previous models, the major difference both in the ouptut (the graph on Figure 7.10) and the input (the code) is the absence of validation (or testing) data. One reason for that is because Keras is very restrictive on RNNs and imposes that both the training and testing samples share the same dimensions. In our situation this is obviously not the case, hence we must bypass this obstacle by duplicating the model.

new_model = keras.Sequential()

new_model.add(layers.GRU(16,

batch_input_shape = (nb_stocks, nb_dates_test, nb_feats), # New dimensions

activation='tanh', # Activation function

return_sequences=True)) # Return the full sequence

new_model.add(layers.Dense(1)) # Output dimension

new_model.set_weights(model_RNN.get_weights())

Finally, once the new model is ready, and with the matching dimensions, we can push forward to predicting the test values. We resort to the predict() function and immediately compute the hit ratio obtained by the model.

pred_rnn = new_model.predict(test_features_rnn, batch_size = nb_stocks) # Predictions

hitratio = np.mean(np.multiply(pred_rnn,test_labels_rnn) > 0) # Hit ratio

print(f'Hit Ratio: {hitratio}')

Hit Ratio: 0.498276586801177

The hit ratio is close to 50%, hence the model does hardly better than coin tossing.

Before we close this section on RNNs, we mention a new type architecture, called $α$-RNN which are simpler compared to LSTMs and GRUs. They consist in vanilla RNNs to which a simple autocorrelation is added to generate long term memory. We refer to the paper Matthew F Dixon (2020) for more details on this subject.

In this section, we present other network structures. Because they are less mainstream and often harder to implement, we do not propose code examples and stick to theoretical introductions.

The idea of Generative Adversarial Networks (GANs) is to improve the accuracy of a classical neural network by trying to fool it. This very popular idea was introduced by Goodfellow et al. (2014). Imagine you are an expert in Picasso paintings and that you boast about being able to easily recognize any piece of work from the painter. One way to refine your skill is to test them against a counterfeiter. A true expert should be able to discriminate between a true original Picasso and one emanating from a forger. This is the principle of GANs.

GANs consist in two neural networks: the first one tries to learn and the second one tries to fool the first (induce it into error). Just like in the example above, there are also two sets of data: one ($\textbf{x}$) is true (or correct), stemming from a classical training sample and the other one ($\textbf{x}$) is fake and generated by the counterfeiter network.

In the GAN nomenclature, the network that learns is $D$ because it is supposed to discriminate, while the forger is $G$ because it generates false data. In their original formulation, GANs are aimed at classifying. To ease the presentation, we keep this scope. The discriminant network has a simple (scalar) output: the probability that its input comes from true data (versus fake data). The input of $G$ is some arbitrary noise and its output has the same shape/form as the input of $D$.

We state the theoretical formula of a GAN directly and comment on it below. $D$ and $G$ play the following minimax game:

First, let us decompose this expression in its two parts (the optimizers). The first part (i.e., the first max) is the classical one: the algorithm seeks to maximize the probability of assigning the correct label to all examples it seeks to classify. As is done in economics and finance, the program does not maximize $D(\textbf{x})$ itself on average, but rather a functional form (like a utility function).

On the left side, since the expectation is driven by $\textbf{x}$, the objective must be increasing in the output. On the right side, where the expectation is evaluated over the fake instances, the right classification is the opposite, i.e., $1-D(G(\textbf{z}))$.

The second, overarching, part seeks to minimize the performance of the algorithm on the simulated data: it aims at shrinking the odds that $D$ finds out that the data is indeed corrupt. A summarized version of the structure of the network is provided below in Figure (7.8).

In ML-based asset pricing, the most notable application of GANs was introduced in Luyang Chen, Pelger, and Zhu (2020). Their aim is to make use of the method of moment expression

which is an application of Equation (3.7) where the instrumental variables $I_{t,n}$ are firm-dependent (e.g., characteristics and attributes) while the $I_t$ are macro-economic variables (aggregate dividend yield, volatility level, credit spread, term spread, etc.). The function $g$ yields a $d$-dimensional output, so that the above equation leads to $d$ moment conditions. The trick is to model the SDF as an unknown combination of assets $M_{t+1}=1-\sum_{n=1}^Nw(I_t,I_{t,n})r_{t+1,n}$. The primary discriminatory network ($D$) is the one that approximates the SDF via the weights $w(I_t,I_{t,n})$. The secondary generative network is the one that creates the moment condition through $g(I_t,I_{t,n})$ in the above equation.

The full specification of the network is given by the program:

where the $L^2$ norm applies on the $d$ values generated via $g$. The asset pricing equations (moments) are not treated as equalities but as a relationship that is approximated. The network defined by $\textbf{w}$ is the asset pricing modeler and tries to determine the best possible model, while the network defined by $\textbf{g}$ seeks to find the worst possible conditions so that the model performs badly. We refer to the original article for the full specification of both networks. In their empirical section, Luyang Chen, Pelger, and Zhu (2020) report that adopting a strong structure driven by asset pricing imperatives add values compared to a pure predictive ‘vanilla’ approach such as the one detailed in Gu, Kelly, and Xiu (2020b). The out-of-sample behavior of decile sorted portfolios (based on the model’s prediction) display a monotonic pattern with respect to the order of the deciles.

GANs can also be used to generate artificial financial data (see Efimov and Xu (2019), Marti (2019), Wiese et al. (2020), Ni et al. (2020), and, relatedly, Buehler et al. (2020)), but this topic is outside the scope of the book.

In the recent literature, autoencoders (AEs) are used in Huck (2019) (portfolio management), and Gu, Kelly, and Xiu (2020a) (asset pricing).

AEs are a strange family of neural networks because they are classified among non-supervised algorithms. In the supervised jargon, their label is equal to the input. Like GANS, autoencoders consist of two networks, though the structure is very different: the first network encodes the input into some intermediary output (usually called the code), and the second network decodes the code into a modified version of the input.

Because autoencoders do not belong to the large family of supervised algorithms, we postpone their presentation to Section 15.2.3.

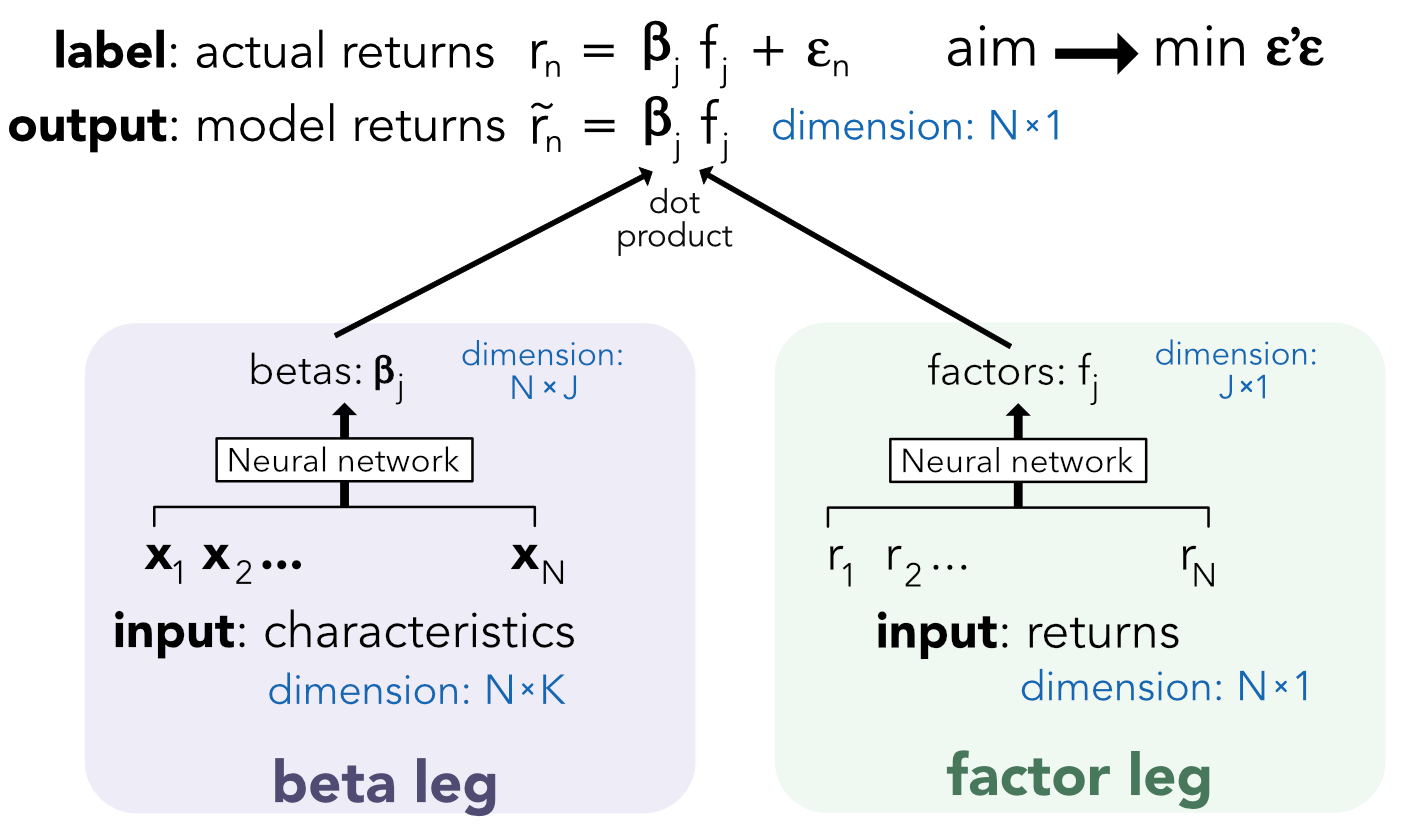

The article Gu, Kelly, and Xiu (2020a) resorts to the idea of AEs while at the same time augmenting the complexity of their asset pricing model. From the simple specification $r_t=\boldsymbol{\beta}_{t-1}\textbf{f}_t+e_t$ (we omit asset dependence for notational simplicity), they add the assumptions that the betas depend on firm characteristics, while the factors are possibly nonlinear functions of the returns themselves. The model takes the following form:

where $\textbf{NN}_{\textbf{beta}}$ and $\textbf{NN}_{\textbf{factor}}$ are two neural networks. The above equation looks like an autoencoder because the returns are both inputs and outputs. However, the additional complexity comes from the second neural network $\textbf{NN}_{\textbf{beta}}$. Modern neural network libraries such as Keras allow for customized models like the one above. The coding of this structure is left as exercise (see below).

Neural networks gained popularity during the 2010 decade thanks to a series of successes in computer vision competitions. The algorithms behind these advances are convolutional neural networks (CNNs). While they may seem a surprising choice for financial predictions, several teams of researchers in the Computer Science field have proposed approaches that rely on this variation of neural networks (J.-F. Chen et al. (2016), Loreggia et al. (2016), Dingli and Fournier (2017), Tsantekidis et al. (2017), Hoseinzade and Haratizadeh (2019)). Recently, J. Jiang, Kelly, and Xiu (2020) propose to extract signals from images of price trends. Hence, we briefly present the principle in this final section on neural networks. We lay out the presentation for CNNs of dimension two, but they can also be used in dimension one or three.

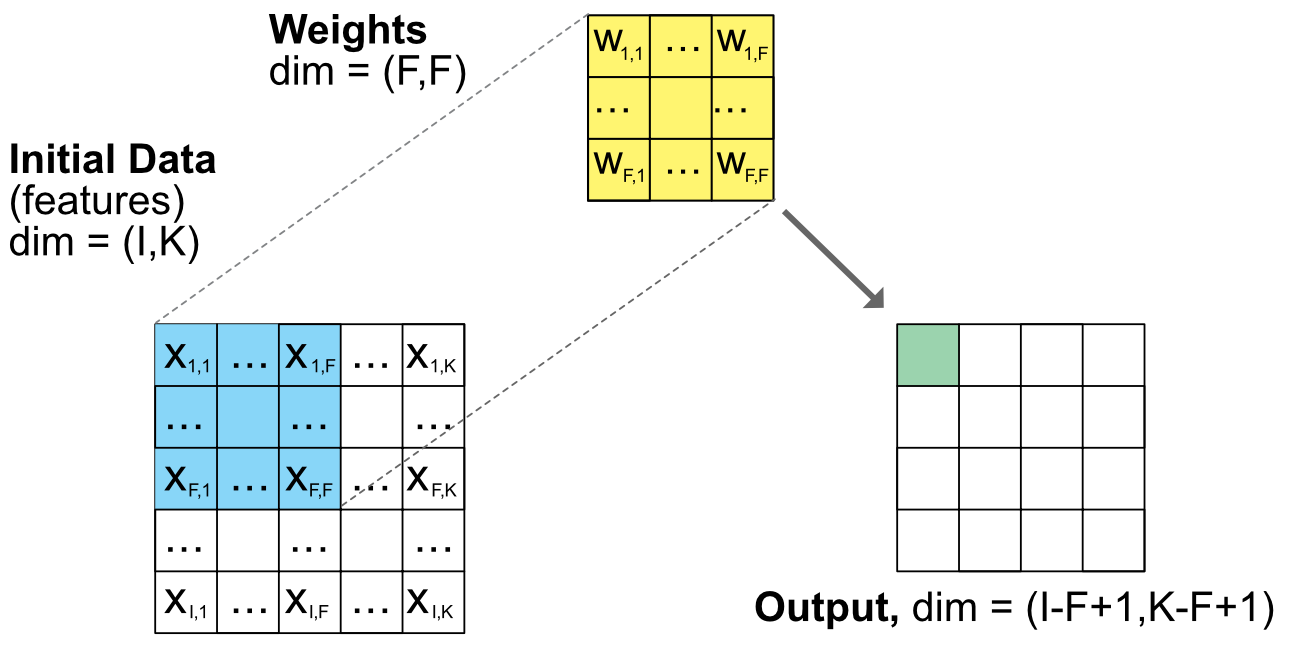

The reason why CNNs are useful is because they allow to progressively reduce the dimension of a large dataset by keeping local information. An image is a rectangle of pixels. Each pixel is usually coded via three layers, one for each color: red, blue and green. But to keep things simple, let’s just consider one layer of, say 1,000 by 1,000 pixels, with one value for each pixel. In order to analyze the content of this image, a convolutional layer will reduce the dimension of inputs by resorting to some convolution. Visually, this simplification is performed by scanning and altering the values using rectangles with arbitrary weights.

Figure 7.11 sketches this process (it is strongly inspired by Hoseinzade and Haratizadeh (2019)). The original data is a matrix $(I\times K)$ $(I\times K)$ and the weights are also a matrixb $w_{j,l}$ of size $(J\times L)$ with $J<I$ and $L<K$. The scanning transforms each rectangle of size $(J\times L)$ into one real number. Hence, the output has a smaller size: $(I-J+1)\times(K-L+1)$. If $I=K=1,000$ and $I=K=1,000$, then the output has dimension $(800\times 800)$ which is already much smaller. The output values are given by

FIGURE 7.11: Scheme of a convolutional unit. Note: the dimensions are general and do not correspond to the number of squares.

FIGURE 7.11: Scheme of a convolutional unit. Note: the dimensions are general and do not correspond to the number of squares.

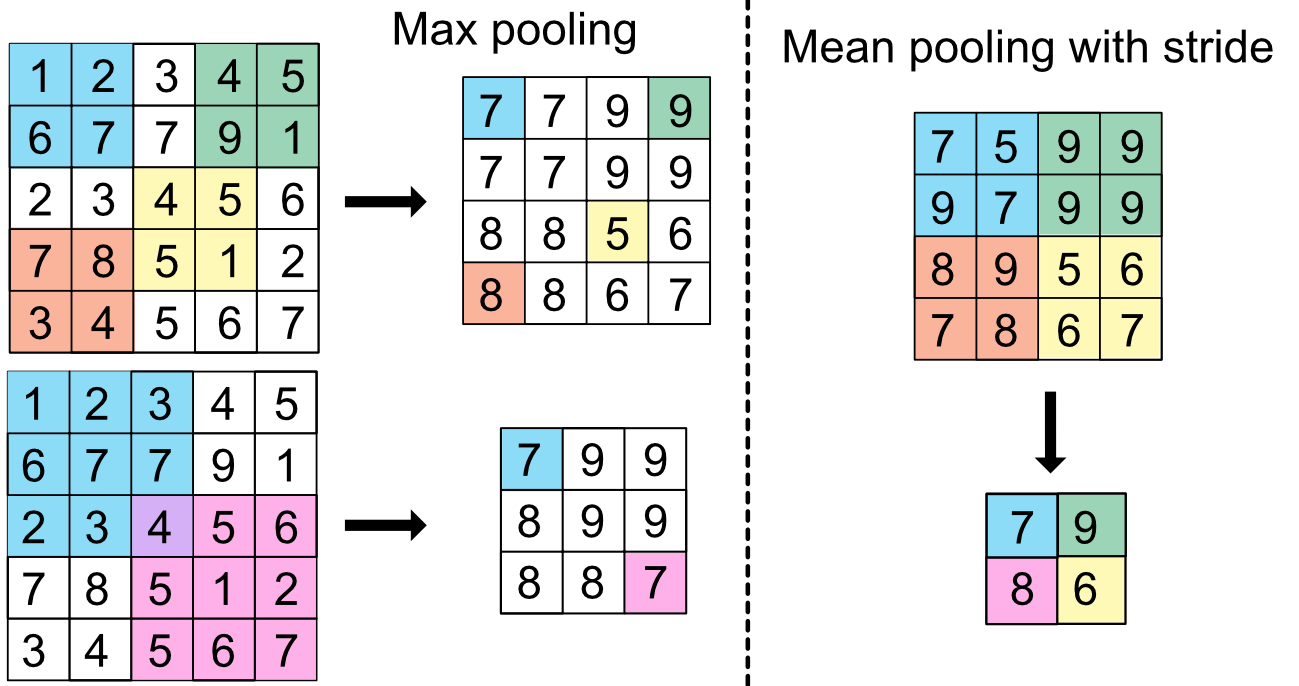

Iteratively reducing the dimension of the output via sequences of convolutional layers like the one presented above would be costly in computation and could give rise to overfitting because the number of weights would be incredibly large. In order to efficiently reduce the size of outputs, pooling layers are often used. The job of pooling units is to simplify matrices by reducing them to a simple metric such as the minimum, maximum or average value of the matrix:

where $f$ is the minimum, maximum or average value. We show examples of pooling in Figure 7.12 below. In order to increase the speed of compression, it is possible to add a stride to omit cells. A stride value of $v$ will perform the operation only every $v$ value and hence bypass intermediate steps. In Figure 7.12, the two cases on the left do not resort to pooling, hence the reduction in dimension is exactly equal to the size of the pooling size. When stride is into action (right pane), the reduction is more marked. From a 1,000 by 1,000 input, a 2-by-2 pooling layer with stride 2 will yield a 500-by-500 output: the dimension is shrinked fourfold, as in the right scheme of Figure 7.12.

FIGURE 7.12: Scheme of pooling units.

FIGURE 7.12: Scheme of pooling units.

With these tools in hand, it is possible to build new predictive tools. In Hoseinzade and Haratizadeh (2019), predictors such as price quotes, technical indicators and macro-economic data are fed to a complex neural network with 6 layers in order to predict the sign of price variations. While this is clearly an interesting computer science exercise, the deep economic motivation behind this choice of architecture remains unclear. Sangadiev et al. (2020) use CNN to build portfolios relying on limit order book data.

The superiority of neural networks in tasks related to computer vision and natural language processing is now well established. However, in many ML tournaments in the 2010 decade, neural networks have often been surpassed by tree-based models when dealing with tabular data. This puzzle encouraged researchers to construct novel NN structures that are better suited to tabular databases. Examples include Arik and Pfister (2019) and Popov, Morozov, and Babenko (2019), but their ideas lie outside the scope of this book. Surprisingly, the reverse idea also exists: Nuti, Rugama, and Thommen (2019) try to adapt trees and random forests so that they behave more like neural networks. The interested reader can have a look at the original papers.

The purpose of the exercise is to code the autoencoder model described in Gu, Kelly, and Xiu (2020a) (see Section 7.6.2). When coding NNs, the dimensions must be rigorously reported. This is why we reproduce a diagram of the model in Figure 7.13 which clearly shows the inputs and outputs along with their dimensions.

FIGURE 7.13: Scheme of the autoencoder pricing model.

FIGURE 7.13: Scheme of the autoencoder pricing model.

In order to harness the full potential of Keras, it is imperative to switch to more general formulations of NNs. This can be done via the so-called functional API: https://keras.io/guides/functional_api/.

Aldridge, Irene, and Marco Avellaneda. 2019. “Neural Networks in Finance: Design and Performance.” Journal of Financial Data Science 1 (4): 39–62.

Anderson, James A, and Edward Rosenfeld. 2000. Talking Nets: An Oral History of Neural Networks. MIT Press.

Arik, Sercan O, and Tomas Pfister. 2019. “TabNet: Attentive Interpretable Tabular Learning.” arXiv Preprint, no. 1908.07442.

Babiak, Mykola, and Jozef Barunik. 2020. “Deep Learning, Predictability, and Optimal Portfolio Returns.” arXiv Preprint, no. 2009.03394.

Bansal, Ravi, and Salim Viswanathan. 1993. “No Arbitrage and Arbitrage Pricing: A New Approach.” Journal of Finance 48 (4): 1231–62.

Barron, Andrew R. 1993. “Universal Approximation Bounds for Superpositions of a Sigmoidal Function.” IEEE Transactions on Information Theory 39 (3): 930–45.

Barron, Andrew R. 1994. “Approximation and Estimation Bounds for Artificial Neural Networks.” Machine Learning 14 (1): 115–33.

Bengio, Yoshua. 2012. “Practical Recommendations for Gradient-Based Training of Deep Architectures.” In Neural Networks: Tricks of the Trade, 437–78. Springer.

Buehler, Hans, Blanka Horvath, Terry Lyons, Imanol Perez Arribas, and Ben Wood. 2020. “Generating Financial Markets with Signatures.” SSRN Working Paper 3657366.

Burrell, Phillip R., and Bukola Otulayo Folarin. 1997. “The Impact of Neural Networks in Finance.” Neural Computing & Applications 6 (4): 193–200.

Chen, Jou-Fan, Wei-Lun Chen, Chun-Ping Huang, Szu-Hao Huang, and An-Pin Chen. 2016. “Financial Time-Series Data Analysis Using Deep Convolutional Neural Networks.” In 2016 7th International Conference on Cloud Computing and Big Data (Ccbd), 87–92. IEEE.

Chen, Luyang, Markus Pelger, and Jason Zhu. 2020. “Deep Learning in Asset Pricing.” SSRN Working Paper 3350138.

Chollet, François. 2017. Deep Learning with Python. Manning Publications Company.

Chung, Junyoung, Caglar Gulcehre, Kyunghyun Cho, and Yoshua Bengio. 2015. “Gated Feedback Recurrent Neural Networks.” In International Conference on Machine Learning, 2067–75.

Costarelli, Danilo, Renato Spigler, and Gianluca Vinti. 2016. “A Survey on Approximation by Means of Neural Network Operators.” Journal of NeuroTechnology 1 (1).

Cybenko, George. 1989. “Approximation by Superpositions of a Sigmoidal Function.” Mathematics of Control, Signals and Systems 2 (4): 303–14.

Dingli, Alexiei, and Karl Sant Fournier. 2017. “Financial Time Series Forecasting–a Deep Learning Approach.” International Journal of Machine Learning and Computing 7 (5): 118–22.

Dixon, Matthew F. 2020. “Industrial Forecasting with Exponentially Smoothed Recurrent Neural Networks.” SSRN Working Paper, no. 3572181.

Du, Ke-Lin, and Madisetti NS Swamy. 2013. Neural Networks and Statistical Learning. Springer Science & Business Media.

Duchi, John, Elad Hazan, and Yoram Singer. 2011. “Adaptive Subgradient Methods for Online Learning and Stochastic Optimization.” Journal of Machine Learning Research 12 (Jul): 2121–59.

Eakins, Stanley G, Stanley R Stansell, and James F Buck. 1998. “Analyzing the Nature of Institutional Demand for Common Stocks.” Quarterly Journal of Business and Economics, 33–48.

Efimov, Dmitry, and Di Xu. 2019. “Using Generative Adversarial Networks to Synthesize Artificial Financial Datasets.” Proceedings of the Conference on Neural Information Processing Systems.

Elman, Jeffrey L. 1990. “Finding Structure in Time.” Cognitive Science 14 (2): 179–211.

Enke, David, and Suraphan Thawornwong. 2005. “The Use of Data Mining and Neural Networks for Forecasting Stock Market Returns.” Expert Systems with Applications 29 (4): 927–40.

Feng, Guanhao, Nicholas G Polson, and Jianeng Xu. 2019. “Deep Learning in Characteristics-Sorted Factor Models.” SSRN Working Paper 3243683.

Fischer, Thomas, and Christopher Krauss. 2018. “Deep Learning with Long Short-Term Memory Networks for Financial Market Predictions.” European Journal of Operational Research 270 (2): 654–69.

Goodfellow, Ian, Yoshua Bengio, Aaron Courville, and Yoshua Bengio. 2016. Deep Learning. MIT Press Cambridge.

Goodfellow, Ian, Jean Pouget-Abadie, Mehdi Mirza, Bing Xu, David Warde-Farley, Sherjil Ozair, Aaron Courville, and Yoshua Bengio. 2014. “Generative Adversarial Nets.” In Advances in Neural Information Processing Systems, 2672–80.

Gu, Shihao, Bryan T Kelly, and Dacheng Xiu. 2020a. “Autoencoder Asset Pricing Models.” Journal of Econometrics Forthcoming.

Gu, Shihao, Bryan T Kelly, and Dacheng Xiu. 2020b. “Empirical Asset Pricing via Machine Learning.” Review of Financial Studies 33 (5): 2223–73.

Guliyev, Namig J, and Vugar E Ismailov. 2018. “On the Approximation by Single Hidden Layer Feedforward Neural Networks with Fixed Weights.” Neural Networks 98: 296–304.

Guresen, Erkam, Gulgun Kayakutlu, and Tugrul U Daim. 2011. “Using Artificial Neural Network Models in Stock Market Index Prediction.” Expert Systems with Applications 38 (8): 10389–97.

Hanin, Boris, and David Rolnick. 2018. “How to Start Training: The Effect of Initialization and Architecture.” In Advances in Neural Information Processing Systems, 571–81.

Haykin, Simon S. 2009. Neural Networks and Learning Machines. Prentice Hall.

Hochreiter, Sepp, and Jürgen Schmidhuber. 1997. “Long Short-Term Memory.” Neural Computation 9 (8): 1735–80.

Hoseinzade, Ehsan, and Saman Haratizadeh. 2019. “CNNpred: CNN-Based Stock Market Prediction Using a Diverse Set of Variables.” Expert Systems with Applications 129: 273–85.

Huck, Nicolas. 2019. “Large Data Sets and Machine Learning: Applications to Statistical Arbitrage.” European Journal of Operational Research 278 (1): 330–42.

Jiang, Weiwei. 2020. “Applications of Deep Learning in Stock Market Prediction: Recent Progress.” arXiv Preprint, no. 2003.01859.

Jordan, Michael I. 1997. “Serial Order: A Parallel Distributed Processing Approach.” In Advances in Psychology, 121:471–95.

Kimoto, Takashi, Kazuo Asakawa, Morio Yoda, and Masakazu Takeoka. 1990. “Stock Market Prediction System with Modular Neural Networks.” In 1990 Ijcnn International Joint Conference on Neural Networks, 1–6. IEEE.

Kingma, Diederik P, and Jimmy Ba. 2014. “Adam: A Method for Stochastic Optimization.” arXiv Preprint, no. 1412.6980.

Krauss, Christopher, Xuan Anh Do, and Nicolas Huck. 2017. “Deep Neural Networks, Gradient-Boosted Trees, Random Forests: Statistical Arbitrage on the S&P 500.” European Journal of Operational Research 259 (2): 689–702.

Lee, Sang Il. 2020. “Hyperparameter Optimization for Forecasting Stock Returns.” arXiv Preprint, no. 2001.10278.

Lim, Bryan, and Stefan Zohren. 2020. “Time Series Forecasting with Deep Learning: A Survey.” arXiv Preprint, no. 2004.13408.

Loreggia, Andrea, Yuri Malitsky, Horst Samulowitz, and Vijay Saraswat. 2016. “Deep Learning for Algorithm Portfolios.” In Proceedings of the Thirtieth Aaai Conference on Artificial Intelligence, 1280–6. AAAI Press.

Ma, Yilin, Ruizhu Han, and Weizhong Wang. 2020. “Portfolio Optimization with Return Prediction Using Deep Learning and Machine Learning.” Expert Systems with Applications Forthcoming: 113973.

Marti, Gautier. 2019. “CorrGAN: Sampling Realistic Financial Correlation Matrices Using Generative Adversarial Networks.” arXiv Preprint, no. 1910.09504.

Masters, Timothy. 1993. Practical Neural Network Recipes in C++. Morgan Kaufmann.

Nesterov, Yurii. 1983. “A Method for Unconstrained Convex Minimization Problem with the Rate of Convergence O (1/K^ 2).” In Doklady an Ussr, 269:543–47.

Ni, Hao, Lukasz Szpruch, Magnus Wiese, Shujian Liao, and Baoren Xiao. 2020. “Conditional Sig-Wasserstein GANs for Time Series Generation.” arXiv Preprint, no. 2006.05421.

Nuti, Giuseppe, Lluı́s Antoni Jiménez Rugama, and Kaspar Thommen. 2019. “Adaptive Reticulum.” arXiv Preprint, no. 1912.05901.

Olazaran, Mikel. 1996. “A Sociological Study of the Official History of the Perceptrons Controversy.” Social Studies of Science 26 (3): 611–59.

Orimoloye, Larry Olanrewaju, Ming-Chien Sung, Tiejun Ma, and Johnnie EV Johnson. 2019. “Comparing the Effectiveness of Deep Feedforward Neural Networks and Shallow Architectures for Predicting Stock Price Indices.” Expert Systems with Applications, 112828.

Polyak, Boris T. 1964. “Some Methods of Speeding up the Convergence of Iteration Methods.” USSR Computational Mathematics and Mathematical Physics 4 (5): 1–17.

Popov, Sergei, Stanislav Morozov, and Artem Babenko. 2019. “Neural Oblivious Decision Ensembles for Deep Learning on Tabular Data.” arXiv Preprint, no. 1909.06312.

Rosenblatt, Frank. 1958. “The Perceptron: A Probabilistic Model for Information Storage and Organization in the Brain.” Psychological Review 65 (6): 386.

Sangadiev, Aiusha, Rodrigo Rivera-Castro, Kirill Stepanov, Andrey Poddubny, Kirill Bubenchikov, Nikita Bekezin, Polina Pilyugina, and Evgeny Burnaev. 2020. “DeepFolio: Convolutional Neural Networks for Portfolios with Limit Order Book Data.” arXiv Preprint, no. 2008.12152.

Sezer, Omer Berat, Mehmet Ugur Gudelek, and Ahmet Murat Ozbayoglu. 2019. “Financial Time Series Forecasting with Deep Learning: A Systematic Literature Review: 2005-2019.” arXiv Preprint, no. 1911.13288.

Smith, Leslie N. 2018. “A Disciplined Approach to Neural Network Hyper-Parameters: Part 1–Learning Rate, Batch Size, Momentum, and Weight Decay.” arXiv Preprint, no. 1803.09820.

Soleymani, Farzan, and Eric Paquet. 2020. “Financial Portfolio Optimization with Online Deep Reinforcement Learning and Restricted Stacked Autoencoder-Deepbreath.” Expert Systems with Applications Forthcoming: 113456.

Srivastava, Nitish, Geoffrey Hinton, Alex Krizhevsky, Ilya Sutskever, and Ruslan Salakhutdinov. 2014. “Dropout: A Simple Way to Prevent Neural Networks from Overfitting.” Journal of Machine Learning Research 15 (1): 1929–58.

Tsantekidis, Avraam, Nikolaos Passalis, Anastasios Tefas, Juho Kanniainen, Moncef Gabbouj, and Alexandros Iosifidis. 2017. “Forecasting Stock Prices from the Limit Order Book Using Convolutional Neural Networks.” In 2017 Ieee 19th Conference on Business Informatics (Cbi), 1:7–12.

Wang, Wuyu, Weizi Li, Ning Zhang, and Kecheng Liu. 2020. “Portfolio Formation with Preselection Using Deep Learning from Long-Term Financial Data.” Expert Systems with Applications 143: 113042.

Wiese, Magnus, Robert Knobloch, Ralf Korn, and Peter Kretschmer. 2020. “Quant Gans: Deep Generation of Financial Time Series.” Quantitative Finance Forthcoming.

Zeiler, Matthew D. 2012. “ADADELTA: An Adaptive Learning Rate Method.” arXiv Preprint, no. 1212.5701.

Zhang, Yudong, and Lenan Wu. 2009. “Stock Market Prediction of S&P 500 via Combination of Improved Bco Approach and Bp Neural Network.” Expert Systems with Applications 36 (5): 8849–54.

footnotes

Neural networks have also been recently applied to derivatives pricing and hedging, see for instance the work of Buehler et al. (2019) and Andersson and Oosterlee (2020) and the survey by Ruf and Wang (2019). In Wu et al. (2020), it is found that deep learning is efficient for selecting performing hedge funds. Limit order book modelling is also an expanding field for neural network applications (Sirignano and Cont (2019), Wallbridge (2020)).↩︎

In case of package conflicts, use keras::get_weights(model). Indeed, another package in the machine learning landscape, yardstick, uses the function name “get_weights”.↩︎